This week we will take a look at the empty promise that we hear so many people make to themselves and to their loved-ones! This empty promise is akin to playing Russian Roulette with your loved-ones' financial well-being.....if you are a selfish gambler then perhaps its OK, for the rest of us it simply isn't, no matter what hat we're wearing!

What in the blue-blazes are we talking about? We are talking about the gamble we hear so often, whereby a couple are taking out a new mortgage, and when faced with whether to put in place just the Mortgage Protection, or to comprehensively cover themselves by taking Mortgage Protection as well as an element of Personal Life Cover. Many many people make the empty promise when they say "We'll do the Mortgage Protection now, and sure we'll do some sort of personal Life Cover once things settle down".....that is a "I'm happy to gamble with my families financial well-being" if ever we heard one!!

In this episode we are going to initially look at the basics of the two types of cover....just so we're all on the same hymn sheet! In a few minutes we'll then dissect the merit of the advice to pay for both Mortgage Protection & Life Cover. We'll uncover if having both is as useless as a chocolate fireguard, or if it is actually a prudent and necessary approach to take when it comes to protecting your yourself and your family, and indeed your financial plans here in Ireland.

Firstly, and as always, we are chuffed that you have checked out our award winning Irish Financial Planning & Money Management blog & podcast. We are on a mission to make financial planning accessible to Ireland's millennials! We ask for your help to spread the word, share the article with the little icons at the bottom, check out the podcast, and in general just be a huge fan of our little site! Be delighted if you checked out our why.

Welcome to our 61st edition of the informed Decisions Financial Planning Blog & Podcast. Did we mention we were recently voted Ireland's best?? Yes, we are Ireland's #1 Finance Blog & Podcast...!

To celebrate our 61st Podcast we are joined by the one and only Emma Kennedy, journalist & up to recently Editor of Money section in Sunday Business Post.

We get to explore Emma's thoughts and experience in regards lots of topics, Kids & Money, Mortgages, Pension Reforms and the make up of Financial Planning services in Ireland as of today.

We do hope you enjoy this episode, we certainly did enjoy creating it! If you have any questions please do drop us an email, and if you really do enjoy the show we'd be hugely grateful of an iTunes Review!!

Thanks so much for checking this out.

Paddy Delaney

QFA | RPA | APA | Qualified Coach

Two lads were standing at the bar of a Friday night in October....their kids put to bed, they gather for their monthly 'Fischers Friday' in their local pub!

Lad #1: "Hey, they're telling me I should do this AVC pension in work"

Lad #2: "Whats an AVC?? Sure do you not have a pension already in work?"

Lad #1: "Eh, yeah I do yeah but yer one said I should set up this other one to give me more of a lump sum in 20 years!"

Lad #2: "Sure jaysus you could be dead in 2, whats the point in doing an ABC or AVC or whatever it's called?!"

Lad #1: "Yeah but she said that if I don't do it i'll miss out on a load of tax reliefs or somethin"

Lad #2: "Tax relief me eye, sure if you put it all into the ABC thing you'd not be able to afford these pints your about to buy!"

Lad #1: "Ha! But yer right, sure yer one was only trying to sell me stuff I suppose"

Lad #2: "Damn right she was, them ones are all the same, pushy pushy, only interested in themselves, ya may tell her to shove her ABCs!"

This wasn't our attempt at a Roddy Doyle sketch, moreso our interpretation of what we believe probably crosses people's minds when they are invited to look at AVCs! They might not verbalise it but they probably think it.....and to a degree they wouldn't be totally wrong!

This week we were contacted by one of the national papers for our comments on AVCs; the pros and cons as it were. We gladly gave our views, and though it wasn't on the agenda this week we decided to do a piece on AVCs.......it's over-due in fairness! We are hoping to dig into the ABCs of AVCs a little, keeping it simple and looking at it slightly differently, as we do!

Firstly, and as always, we are chuffed that you have checked out our award winning Irish Financial Planning & Money Management blog & podcast. We are on a mission to make financial planning accessible to Ireland's millennials! We ask for your help to spread the word, share the article with the little icons at the bottom, check out the podcast, and in general just be a huge fan of our little site! Be delighted if you checked out our why.

So how about we look at that wee conversation above and take it line by line, figure out how right or no they are! Before we begin, in order for an AVC to be of any appeal to you, you need to have A) an understanding of what it is B) clarity on how it will benefit you (or not) in the long term & C) the disposable cash to put into it!.............................................www.informeddecisions.ie/podcast59

OK, we were being a bit mischievous in calling it 'owning'.....but if you have one you'll know that the responsibility lies squarely on your shoulders.....so you may as well 'own' the little darling!! We are not just gonna list off the usual baby stuff, as we like to do here we are going to invite you to think about it a little differently! There are stats which say it costs €250k to raise a child. We're gonna bust through that and break it down a bit more practically!

Many of our readers have kids, and indeed a lot do not, yet! In this episode we are hoping to give some bit of insight to readers on what can be expected financially when you are expecting & beyond.....

This episode is a major departure from the last few weeks where we focused on investment rebalancing, investment portfolios and the impact of time on your investment success. So if it doesn't hit the mark for you then please let us know!! Feedback is gold!

Firstly, and as always, we are chuffed that you have checked out our website & podcast. We are on a mission to make financial planning accessible to Ireland's normal folk in their 20s & 30s (millennials!?). We ask for your help to spread the word, share the article with the little icons at the bottom, check out the podcast, and in general just be a huge fan of our little site! Be delighted if you checked out our why.

This episode does not address the costs of trying to conceive and the various medical methods to do that. While this is something which is faced by many many couples, we empathise however we really don't know enough about it here to put together helpful information.

Intro:

So if you are expecting or indeed planning on expecting a wee baby and are wondering how much does it costs to have a child, you are a planful individual! We reckon it is useful to approach this question through 3 different 'trimesters' (like what I did there!?).....the short, medium & the long term.

The short term expenses include everything in the run-up and indeed the first year or so of the child's glorious existence, medium term is from year 1 to year 5, while the long term is everything after that! Let's take a quick look at the main costs of having a baby, on the short term.....

The Short Term:

You don't need us to inform you that there are costs associated with having a baby even before he or she gets here! Here's a broad summary of what you'll be looking at!

Medical Costs: Ranging from €3k to €5k if you decide to use the 'Private' maternity service in your chosen hospital. If you decide to go 'Semi-Private' it will be in the €1k to €2k region, while if you decide to go 'Public' you'll be getting it for all but free. The decision as to which route to go is a very personal one, and in most cases doesn't come down to cost anyway!

There's not too many mammies who would be happy to let a baby arrive home without having all the necessary accouterments! So broadly speaking here's a broad tally of the main bits needed;

Cot/Crib/Changer: €300-€1000

Clothing/Blankets: €200-€500

Buggy/Car Seat ('Travel System'!): €300-€1500

Breast or Bottle Fed: €0- €600

That quick scan (pardon the pun) of the short term costs tells us that you'll need to prepare for spending anywhere in the region of €800 to €8,500, depending on your preferences....and indeed on how many 2nd hand donations you are willing to accept from friends and family (a great source of stuff in fairness!).

Medium Term (1-5 years old):

So baby is home and settled at this stage, and is starting to crawl/walk and give you back-chat! Happy-Days!

As a responsible parent your instincts will likely kick in and make you notice the advertisements and media articles, forcing you to consider such things are making sure you have proper financial protection & provision if 'anything happens' you!

Emergency Fund:

This nugget has been covered umpteen times in fairness. We even covered it way back here in our 3rd blog post. You may already have one in place, but if you don't it can seem a really daunting mountain to climb....to have a stash of cash equivelant to 3-12 months take-home income. So if you are taking home €3,500 per month, you could be aiming to have €10-€40k of a stash! That's no mean feat but the comfort and peace of mind knowing it's there (or at least is being built) is massive. Follow the suggestions here and you should be OK on this front.

You'll Wanna Be Protected:

Again, your instincts will probably drive you to take notice of all the countless ads for Life Insurance. It is our instinct for survival (and for the survival of our 'off-spring) that motivates us to take this stuff in the first place.....so you'll likely feel the twinge to do something here.

The thoughts of not having it and 'something happening' is far worse that the thoughts of paying for this insurance. Or at least it is for 50% of the parent population in Ireland anyway - that's the rough % who have Life Cover in place!

If you are wondering 'how much life cover should I have' then by all means you can check out this bad-boy here for an idea of the level that would be sensible, and indeed for the different types that are available to you.

If you are particularly planful and your instincts are kicking your backside you might even start to wonder should you have some form of illness cover or indeed an income protection. These insurances all cost money, nobody likes paying for them, but generally people love the peace of mind they provide and the fact that they quieten the nagging instincts! This episode on Income Protection and this episode on Specified Illness Cover might help a little.

Child-Care:

If you take a scenario (which is by far the most common) where both parents are back to work within 12 months of baby's arrival then the inevitable cost of child-minding will rear it's ugly head! There are obviously scenarios where grandparents etc mind the child and insist on not taking any money for that. Count yourself fiercely lucky if that's the case!!

A local childminder or indeed creche, depending on where you are in the country will cost you anything from €40 to €60 per day. Might not sound a lot, but tally that, averaged at €50 per day, over the course of a month, if it is 5 days per week, and you are at €1080 per calendar month. €12,000 per year. To earn €12,000 as a higher tax earner you need to earn approx €24,000 Gross.

If you are on €60,000 per year that is not far off half of your yearly Gross salary...or in another way nearly every second day you go to work is so that you can pay Childminding costs! Not exactly inspirational stuff I understand, but it is a fact!

Taking Time Out:

This leads nicely to the next aspect we invite you to consider, in advance of baby's arrival. Will you actually want to go back to work after maternity/paternity leave is over? Will you be able to afford not to?

This is the single biggest aspect we would invite new or prospective parents to consider. Aside from the financial cost of reducing hours or indeed of doing no hours of paid work, there is the far more important and fulfilling (we would argue!) aspect of having extended time with your child in their early years.

If you were to take unpaid leave from work would your financial lives fall to pieces? How would the mortgage or rent get paid? How would all other bills be managed? Have you actually looked at the maths yourself? This is essentially what Financial Planning is all about, looking ahead and figuring our what you want to do with your time, as well as with your money! We saw how much of a dent on your salary that Childminding can have....you would obviously be saving yourself that chunk if you were not working and were doing that yourself!

If your married couple have only one earned income between them, as of January 2018, that household will be able to earn €43,550 before being hit with the higher rate of tax. In essence what this means is that the effective rate of tax on the household income would obviously be less if only 1 person is earning an income, meaning the 'worker' would find they take home more Net Income if the other spouse takes time out.

Taking time out is not obviously a necessity, it is a choice. We invite you to consider if this is a likely choice you want to make, and to plan for it if it is something you aim to do.

Long Term (6 years and beyond!):

Aside from feeding a growing child, and aside from everything above and the usual clothing, social, sport and other expenses the most commonly thought-about is Education. While the expenses of National and Secondary school appear mostly manageable to working parents, it is the looming 3rd level education which causes most parents to squirm!

We have covered it before, the most common ways to prepare for the costs of college fees. Indeed it was such a big subject matter that we had to split it into 2 parts, Part 1 & Part 2!

If you have young kids at this stage you might feel that College fees are a long way away, and you'd be right. Having said that unless you have the money already set aside for it (€11k per year per child) now might be a good time to start figuring out how you are going to pay for it all!

Nonesense:

As much as we love the topics we cover here, and sharing ideas with like-minded people to help them manage their money the idea that you will or won't have kids based on the financial aspects is a little 'off' if you ask us. Yes it is prudent to be prepared and planful but for those of us who are lucky enough to be able to have and care for their own child it is our primal instinct to create and give another being the chance to live a fulfilled and fun-filled life.....money is unlikely to come into that debate....it may, but it will unlikey be the decider! So take all of these articles about the financials of kids with a pinch of salt, take what nuggets you like from them, but please don't let it scare you, you'l be awesome!!

Thanks a mill for reading (and sharing). We'd love you have you join our community.

Paddy Delaney

QFA | RPA | APA | Qualified Coach

This week we take on a subject which, while not that earth-movingly exciting, has gained in popularity over recent years in the investment industry, and that subject is rebalancing.

Rebalancing, in the simplest and most honest terms can be described as taking money out of your 'winners' and putting it into your 'losers'! Please bear with us and we'll explain!

With lots of lovely head-lines lately talking about Equities at all-time highs and general euphoria about investing.......it might (or might not pay) to be aware of rebalancing, and how it impacts on your investments.

When it comes to Investing & Pension Funds in Ireland in 2017 or indeed most aspects of creating investment portfolios, since 2008 there has been a sharp focus on ensuring that investments are well diversified. Due to the scorchingly severe falls in values of equities and property at that time people have been once bitten and are now twice shy. There is now a big push to diversify between different asset classes to reduce that volatility & who'd blame them.....even though it this does fly in the face of the fact that a broadly held basket of equities outperforms any other asset class over the long term!

Product providers and indeed the industry at large now go to great lengths to encourage people to avoid being overly exposed to one particular asset (even if, as already stated, historically one particular asset class has performed above all others!). Investors are now encouraged to have a balance of 2 or more asset classes, such as equities and bonds, or equities, bonds and property etc etc. This is done ultimately in order to try reduce the volatility yet still achieve reasonable returns. For more on diversification by all means this might be useful (or not!).

What is Rebalancing?..............by all means check out our blog version of this episode.....here.

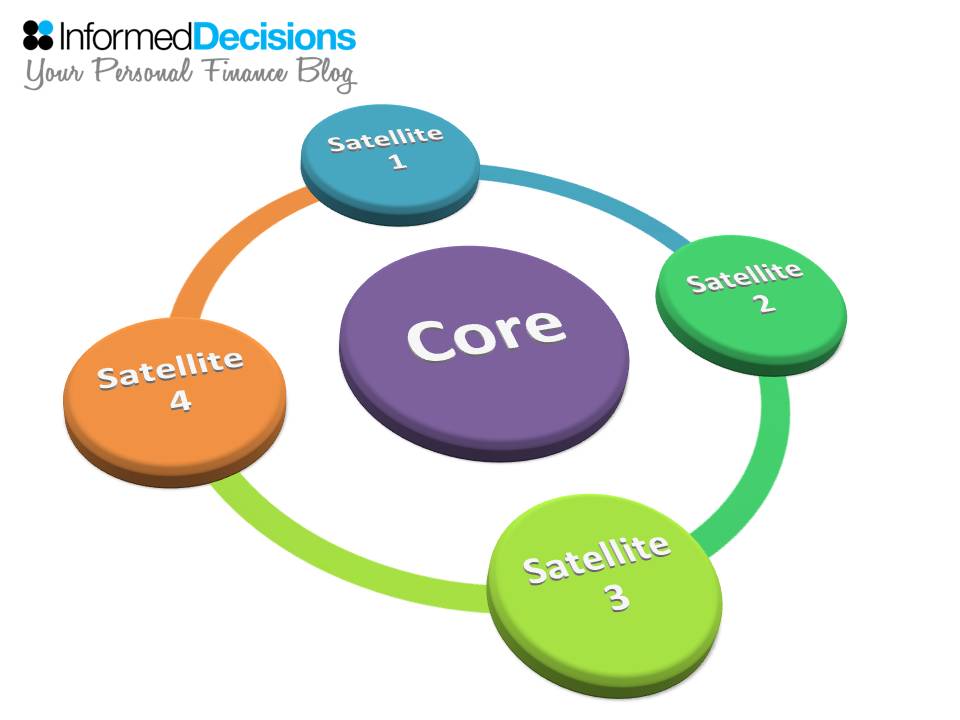

While it might sound a little like a project to build the next NASA space-rocket this is a fairly simple investment approach that Irish investors have access to, so strap yourself in! Before we begin may I outline that the word 'satellite' is one of those words that I really struggle how to spell.....for some reason I keep typing it as 'satelitte'.......so this particular blog might take me a while to get done!!

Anyway, here we will take on the task of sharing ideas with you keen investors on the concept of 'core-satellite' investment portfolios, how to approach it, what to watch out for and ultimately outline the pros and cons of this particular approach. Lovely-jubbly. Core Satellite investment in Ireland will never be the same again!!

What is a Core-Satellite Portfolio?

Core-Satellite is not something you might hear often here in Ireland, however elsewhere in the world, such as US & UK, it is a very well established and indeed popular approach to take to investing your funds.

Ultimately this approach aims to blend the 'best of both worlds', by combining both Passive and Active strategies into the one portfolio. There has been long term debate over which strategy is best for investors. A recent well documented event was Warren Buffet winning a 10 year, 1-million dollar bet with a hedge fund manager that a passive fund would beat an actively managed hedge-fund over 10 years from 2008. To date the passive fund has delivered over 7% while the hedge fund has delivered just over 2%........it was a land-slide. Yet there are periods where an active fund manager has outperformed passive and indeed been able to reduce volatility levels at certain times and in certain markets. Find out a little more about active strategy in our hugely popular interview with Will Spark here.

As a result of this ongoing debate people who are unsure of the long-term best option for them can avail of a 'bit of both' styled approach. That is where core-satellite comes into play, and satisfies that need.

How To Build A Core-Satellite Portfolio?

A portfolio is just a fancy way of saying, 'a mix of investments/holding'. Its one of these words that sounds nonce, it's straight-forward however! You can create a portfolio with a trusted advisor (our default recommendation!) or you can build one yourself and attempt to manage it over the years directly with an investment firm or online trading. You simply purchase the appropriate funds/holdings and re-balance it each year or so (we'll have an episode on what re-balancing is all about very soon!).

Provided you have set up your portfolio (mix of stuff!) in line with your appetite and tolerance for volatility and indeed your long term objective there is no need to ever alter the portfolio. If your long term plan doesn't change then there really is no need to change the mix.

In any core-satellite portfolio there will be a certain percentage in Active and a certain percentage in Passive. The core will naturally form the basis of the portfolio, while the satellite represents the add-ons to the core.

What To Watch Out For?

The split should be based on a number of considerations, including but not limited to the following:

Investor tolerance for volatility

Ability to identify top performing and low-cost Active Managers

% Return needed to achieve the end goal of investor

There are many who would argue that Passive holdings such as Index Funds should form the basis of the core, that historically this offers the greatest return over the long term relative to the risk and volatility. The satellites should be a combination or small selection of managed funds, to offer diversification from the core and a potential to offer growth/stability/selection in preferred investments. Unless you or indeed your trusted advisor are skilled at identifying low cost and high performing Active holdings then it may be a case that having these smaller holdings in your satellites might make some sense.

Others would argue that the Core should be more boring and less volatile investments (holdings), where it is risk-managed and relatively steady, in order to try deliver a certain expected long term return. This would offer scope to go for more exciting and volatile satellites to attempt to drive performance upward. This would, or indeed should, lend itself to more predicable returns over the long term, albeit likely to deliver less return than the above example.

We've said it before and we'll say it again, begin the construction of your portfolio with the end in mind....what is the objective of it, what are you aiming to achieve, what are you willing to accept in terms of volatility in order to achieve it. The questions, or more-so the answers, should be a large determinant in building and choosing the percentages in each.

As a general guideline if an investor is building a core-satellite portfolio typically the core would represent at least 50% of the overall value, the remainder split between one or many satellite holdings.

If you are into Financial Planning and want to be more mindful in your investments then the idea of investing with a particular investment philosophy and plan is a must....otherwise it is purely investing for the sake of it...and that usually doesn't end well!

Irrespective of whether it is Active or Passive it always pays to be aware of the costs of the funds, getting access to the Total Expense Ratio (TER) or the Ongoing Charges Figure (OCF). For more on the impact of fees on investment growth go here.

Pros & Cons:

In short the pros are that it allows you access to both Passive and Active in a structured manner within a single investment portfolio. It makes it easier to monitor your split between the two strategies and to therefore re-balance it each year to keep it in line with how you initially set it up.

Some of the cons one would see are that it can be difficult to keep a clear line of sight on the overall portfolio it if there are many smaller satellites. It can therefore also tempt an investor to make changes to the portfolio selling and buying satellites irrationally, which more often than not will have a negative impact on it's long term performance.

Bottom-Line:

Core Satellite is a form of portfolio investing. If you are interested in a blend of Active and Passive this approach can make a lot of sense. If you are strongly biased toward either then it can also be a sensible approach to still keep an element of the one you less favour, as always it can add another level of diversification to the portfolio and offer growth/risk-management depending on the blend you opt for.

If this is new to you you may well now think that Core-Satellite seem like a complex sounding name for a fairly straight-forward approach, and you'd be right, it is! However the clearest benefit from our perspective is that it provides a structure around which to build a sensibly constructed portfolio.

Thanks for checking out this episode, and by all means we'd love you to join our growing community of 'informed-decisioners' over here!

Thanks for sharing.....

You're a legend!

Paddy

QFA | RPA | APA | Qualified Coach